Medicare And Insulin Coverage

Your Medicare coverage falls under one of two overall plans:

- Original Medicare Part A and B , or

- Medicare Part C .

Lets look at what each plan covers in terms of insulin, other diabetes-controlling drugs, and various diabetic supplies.

- Alcohol swabs

- Gauze

Medicare Part B only covers insulin if you use an external insulin pump. In that case, both the pump and its insulin may be covered under durable medical equipment . You will have to buy them from an approved Medicare DME supplier or a retail pharmacy set up to bill Medicare as a DME supplier.

If your insulin is delivered any way other than an external pump, you will have to opt for coverage with Medicare Part D.

Does Medicare Part C Cover Insulin?

Medicare Advantage is a government-regulated alternative to Original Medicare. It is offered by many private insurance carriers and covers almost everything Original Medicare does. It also covers additional benefits not included in Original Medicare. Most Medicare Advantage plans include prescription drug coverage , which covers insulin.

Different Medicare Advantage plans cover different medications. In selecting a specific plan, check if it covers the insulin prescribed by your doctor. Also, make sure to check the cost online tools allow you to search for available plans by specific medications.

A critical heads-up

Medicare Advantage plans tend to adjust their offerings at the end of the year, which can affect your insulin coverage.

Does Medicare Part D Cover Insulin?

Medicare Part D Costs

Medicare Part D costs consist of premiums, deductibles, and copays. Most people on Part D pay an average premium, which will be $33 per month in 2022, unless you are considered high income. Part D premiums may be higher for people with high incomes. Part D deductibles cannot exceed $480 in 2022. Some Part D plans do not have a deductible at all. Some people may qualify for Extra Help, which may reduce or eliminate these costs.

Helping Medicare Part D Members Save On Insulin

In the United States, there are 34.2 million people with diabetes. And for many, diabetes is an expensive and complex medical condition, often requiring multiple medications including insulin and regular doctor visits. In fact, diabetes is the most expensive chronic condition in the nation. The annual cost of diagnosed diabetes is an estimated $327 billion and climbing.

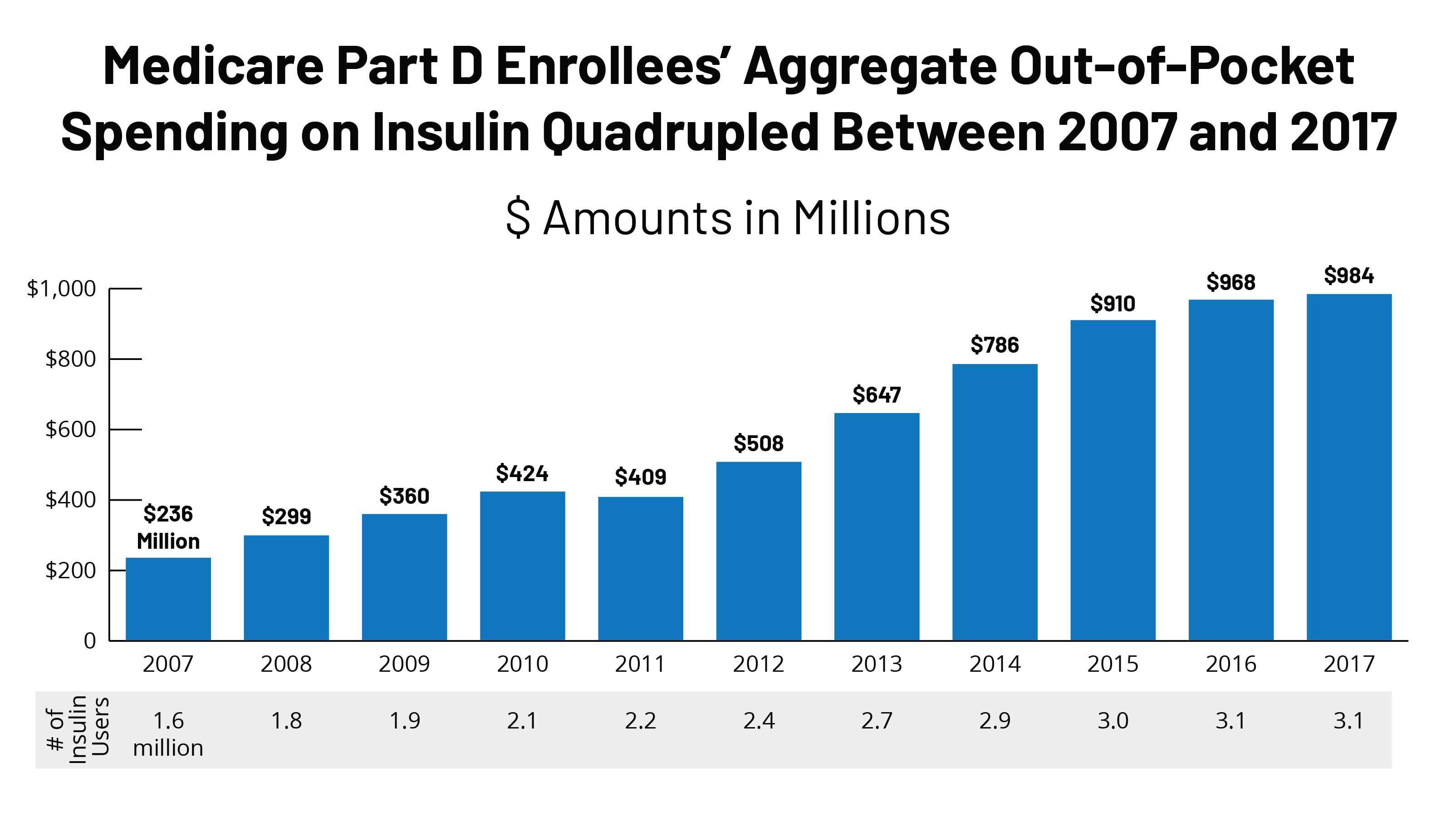

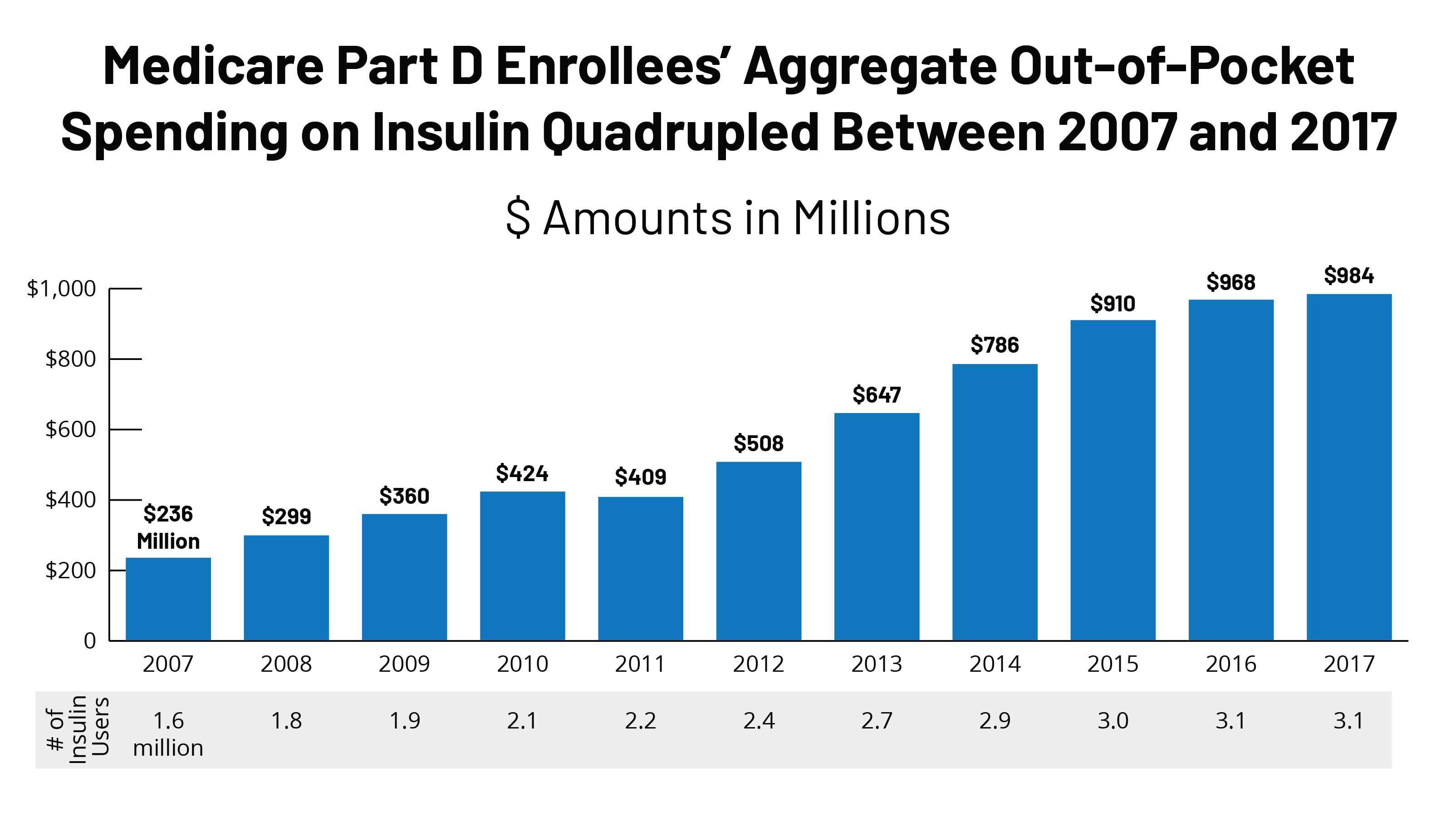

Medicare Part D has helped seniors and other Medicare beneficiaries save billions of dollars on their prescription costs over the last two decades. But still, total out-of-pocket spending on insulin for people with diabetes among those enrolled in Medicare prescription drug plans increasedfrom $236 million to $984 million over a 10-year period.

For these consumers, a change was needed. One in every three Medicare beneficiaries has diabetes, and more than 3.3 million beneficiaries use one or more of the common forms of insulin.

In March 2020,Centers for Medicare & Medicaid Services announced a new Part D Senior Savings Model for people who use insulin. Through this new model, seniors enrolled in participating Medicare Part D insurance plans are able to see their out-of-pocket costs for insulin reduced to $35 per covered prescription during three phases of coverage: the deductible phase, the initial coverage phase and while in the coverage gap. This year, eligible UnitedHealthcare members have saved an average of nearly $450 through the program.

Y0066_211101_115439_M

Also Check: How Do You Screen For Diabetes

Find A Medicare Drug Plan In Your Area

Use the online Medicare Plan Finder tool for a list of the stand-along Part D plans and Medicare Advantage plans with drug insurance available in your ZIP code.16 The comparison tool shows the drugs covered by each plan, cost-sharing amounts, and whether you need prior authorization and preferred pharmacies.

Understanding Medicare Part D Prescription Drug Coverage

An animated white speech bubble appears over an animated character’s green and white head.

ON SCREEN TEXT: What is a Medicare Part D Plan?

The character and speech bubble separate and exit the screen on opposite sides. Blue text appears above a sheet of paper.

ON SCREEN TEXT: Medicare Part D plans are…

The paper and text slide up. Blue text appears, along with blue and white pill bottles.

ON SCREEN TEXT: Stand-alone plans that provide prescription drug coverage.

A bottle covers the text and turns over as pills pour out of it.

ON SCREEN TEXT: Part D plans cover certain common types of drugs as regulated by the federal government, but each plan may choose which specific drugs it covers.

The text disappears as the camera moves down to show another sheet of paper.

ON SCREEN TEXT: The list of drugs a plan covers is called a formulary.

Text appears on the paper.

ON SCREEN TEXT: Part D plans do not cover:

ON SCREEN TEXT: Drugs that aren’t on the plan’s formulary

ON SCREEN TEXT: Drugs that are covered under Medicare Part A or Part B

The text is crossed out with a blue line as the page scrolls down.

ON SCREEN TEXT: Drugs that are excluded by Medicare

More text is crossed out with a blue line. After the page scrolls down, the last chunk of text is crossed out with a blue line. The screen swipes down and white text appears on a blue background.

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare

Don’t Miss: Does Being Diabetic Make You Gain Weight

Diabetes Supplies And Services Covered By Medicare Part B

- Blood glucose testing supplies and equipment

- Insulin pumps and insulin used with a pump

- Diabetes self-management training

- Medical nutrition therapy, including diet and lifestyle counseling

- Hemoglobin A1C tests to monitor blood glucose control

- Foot exams and treatment for diabetes-related nerve damage

- Therapeutic shoes or inserts

Insulin Savings Through The Part D Senior Savings Model

You may be able to get Medicare drug coverage that gives supplemental benefits specifically for insulin. You can get this savings on insulin if you join a Medicare drug plan or Medicare Advantage Plan with drug coverage that participates in the insulin savings model. Participating plans offer coverage choices that include multiple types of insulin at a maximum

of $35 for a month’s supply.

| Note for people with Extra Help |

|---|

|

If you get fullExtra Help, your set copayment for insulin is lower than the $35 copayment for a month’s supply under the Senior Savings Model. If you get partial Extra Help, you may pay up to a $92 deductible and 15% coinsurance, which may be higher or lower than the $35 copayment under the model. Contact 1-800-MEDICARE if you need help checking the level of Extra Help you get. |

Read Also: How Can An Ophthalmologist Help A Diabetic

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

What Is The Average Cost Of Lantus Solostar With Medicare Part D Coverage

Specific costs of Lantus under your Part D plan are likely to vary depending on your location and specific plan. The below table offers insight into the ranges most people can expect to pay for copays and deductibles.

|

Deductible Stage |

Typical Copay Stage |

|

Deductible payments are the payments you need to make for eligible medication before Medicare coverage kicks in. During this phase, you’re responsible for the full cost of treatment. Some Medicare Part D plans have a $0 a month deductible, and as of 2019, the deductible can’t be more than $415 per month. |

Once you’ve met your Medicare drug plan deductible, the initial coverage period commences. During the typical copay stage, you pay a coinsurance percentage or copayment flat fee for eligible prescriptions. As of 2019, you can typically expect to pay between $25 to $484 per month. |

Read Also: Can A Person Get Rid Of Type 2 Diabetes

Trends In Insulin Prices

Among the 22 insulin therapies that have been on the market since at least 2013, 16 products had average annual price increases of more than 10% between 2013 and 2018, as measured by the change total Part D spending per dosage unit between these years, which far exceeded the 1.5% average annual growth in inflation over the same time period .

Figure 6: Average Annual Price Increases for Insulin Products Far Outpaced Inflation Between 2013 and 2018

It is important to note that this spending measure, and total spending as reported in Part D claims, do not account for rebates, which are not publicly available at the individual product level. The Government Accountability Office has estimated rebates of 41% in 2016 for drugs in the therapeutic class that includes insulin. This is higher than the estimated 20% rebate for Part D covered drugs overall in 2016. While gross total Part D spending on insulin increased from $1.4 billion in 2007 to $13.1 billion in 2017, net total spending would be significantly lower after accounting for rebates.

The level of rebates offered by manufacturers for specific drugs influences coverage and tier placement decisions by Part D plans, which in turn affects out-of-pocket costs paid by enrollees. It has been suggested that the magnitude of list price increases for insulin products over time can be attributed to manufacturers offering increasingly larger rebates for these drugs in exchange for preferred formulary coverage.

Foot Exams And Therapeutic Shoes

If a person has nerve damage in one or both feet due to diabetes, Medicare Part B may cover a foot exam every year. A person with diabetes can get coverage if they have not visited a foot care doctor for other medical reasons between visits.

If a person meets three conditions, Medicare Part B may also cover a pair of therapeutic shoes. To qualify, a person must have a diabetes diagnosis and be receiving treatment for diabetes.

As a person must need the shoes or inserts due to diabetes, they must also have:

- undergone a partial or complete foot amputation

- had previous foot ulcers

To get Part B coverage, a doctor must certify a personâs need for therapeutic shoes.

Coverage

A person will generally pay the deductible for Part B, then 20% of the Medicare-approved amount.

You May Like: Is Simvastatin Used For Diabetes

Want To Learn More About The Omnipod Dash System

Omnipod® DASH offers Pod-based insulin management to help you keep diabetes where you want itin the background. A wireless, waterproof,* concealable alternative to traditional pumps that gives you the freedom to simplify every day with diabetes. Get ready for a life without tubes or daily injections.

A Medicare Proposal To Decrease Insulin Costs

In March 2020, the Centers for Medicare and Medicaid Services made a proposal to decrease insulin costs for Medicare beneficiaries. It is referred to as Part D Senior Savings Model and it would require participation from private insurers and pharmaceutical companies. Insurers would decrease insulin copays to $35 per month, saving an estimated 66% or more off current prices and pharmaceutical companies would adjust costs and contribute more towards the coverage gap known as the donut hole.

It is not a mandatory program but one that Medicare Advantage and Part D plans can choose to participate. In return, those plans can offer plans with higher monthly premiums. Eli Lilly and Sanofi reported they planned to take part in the program. Novo Nordisk has not yet made a commitment. Any changes would not take effect until 2021.

While the Part D Senior Savings Model will save Part D beneficiaries on the cost of insulin, it does little to benefit people who use insulin pumps. Insulin used in pumps is covered by Part B, not Part D. A recent analysis reports that under this model insulin pump users will pay more than 50% than people who get their insulin through Part D. More needs to be done to assure fair and equitable pricing so that all people on Medicare can access and afford this life-saving medication.

Don’t Miss: Best Cereal For Pre Diabetics

How Medicare Part B Covers Diabetes

Medicare Part B covers the fasting blood glucose test, which is a diabetes screening. Medicare covers two diabetes screenings each year for beneficiaries who are at high risk for diabetes. High risk factors for diabetes include: high blood pressure, history of abnormal cholesterol and triglyceride levels, obesity, or a history of high blood sugar. If diabetes runs in your family, you may also need regular diabetes testing. Your doctor may also recommend services that Medicare doesnt cover.

You generally pay nothing for these diabetes tests if your doctor accepts the amount approved by Medicare for the diabetes screening. However, you may have to pay 20% of the amount approved by Medicare for the doctors visit.

If your doctor diagnoses you with diabetes, Medicare covers the supplies you need to control your diabetes, including blood sugar testing monitors, blood sugar test strips, lancet devices and lancets, and blood sugar control solutions.

Medicare Part B may cover an external insulin pump and insulin as durable medical equipment. You pay 20% of the amount approved by Medicare, after the yearly Medicare Part B deductible.

Medicare may also cover medical nutrition therapy for diabetes, if referred by a doctor. You pay 20% of the amount approved by Medicare after the yearly Medicare deductible for services related to diabetes.

What Is The Coverage Gap Or Donut Hole

Until your total drug costs hit $4,430, you pay the cost sharing designated in your policy in 2022.

- When you reach the initial coverage limit of $4,430 , you enter the coverage gap, also known as the donut hole.

- You then pay 25% of costs for the costs of brand and generic drugs until your total out-of-pocket Part D spending reaches $7,050

- At that point, the catastrophic limit kicks in and beneficiaries pay the greater of 5% or $3.95 for generic medications and $9.85 for brand-name drugs for the rest of the year.13

Read Also: Patient Teaching On Diabetic Diet

Medicare Part B Costs

Medicare Part B requires a monthly premium for medical coverage, which you must pay in order to be covered. The actual cost varies depending on your income level.

In 2022, most people who are enrolled in Medicare Part B will pay a premium of $158.50 per month . However, if your income is above a certain threshold, you may have to pay more than that amount.

There are also deductibles to consider, along with coinsurance. The Medicare Part B deductible is currently set at $217 for the year 2022 . Youre responsible for paying this deductible amount before Medicare will begin to pay. After that, youre responsible for paying 20% of the Medicare-approved amount for your healthcare expenses and services unless you have a supplemental plan that would cover the rest.

When To Enroll In Medicare Part D

It is important to be aware of your enrollment window for Medicare Part D in order to avoid a costly late enrollment penalty. You are first eligible to enroll in a prescription drug plan during your Initial Enrollment Period .

The Initial Enrollment Period is a 7-month time frame that begins 3 months before your 65th birthday, runs through your birth month, and ends 3 months after your 65th birthday.

If you miss enrolling during your IEP or decide to delay Part D coverage, you will have to pay a late enrollment penalty. The late enrollment penalty is a permanent amount that is added to your monthly Part D premium and remains in place the entire time you are enrolled in a prescription drug plan through Medicare.

If you are already enrolled in a Part D plan and wish to switch to a Senior Savings Model plan that provides predictable insulin coverage, you can do so during the Annual Enrollment Period .

AEP runs from October 15 December 7 each year. This is also the first opportunity for individuals who missed their IEP or delayed enrollment to enroll in a prescription drug plan.

Also Check: How Many People In The Us Have Type 1 Diabetes

What Does Medicare Cover For Diabetics

If you have diabetes, you know its a day-to-day reality that needs to be attended to. It can feel like a full-time job, but you dont have to do it alone.

Medicare covers various diabetes medications, supplies and services to help treat diabetes and keep your blood glucose in a healthy range.

- Medicare Part B covers blood glucose testing and other supplies you may need plus some medical and education services.

- Medicare Part D covers diabetes medications and supplies for injecting or inhaling insulin.

Heres a rundown of the diabetes supplies and services that Medicare covers. Some require a prescription or recommendation from your doctor. Coverage limits may include the amount of some supplies you can get or how often some services are covered.

How Much Do You Pay For Insulin With Extra Or Partial Extra Help

If you receive partial Extra Help, then you could pay up to $92 and 15% coinsurance for each month of insulin you receive through your pharmacy. The amount you pay could be more or less than the insulin savings models $35 fee.

With full Extra Help, the copayment for insulin is less than $35 per month thanks to the Senior Savings Model.

Cal 1-800-MEDICARE if you want to know if you qualify for or receive Extra Help.

You May Like: Is 6.2 A1c Diabetes