What About Complications Caused By Diabetes

If your diabetes has led to complications, like kidney problems, nerve damage, diabetic neuropathy or proteinuria, it will affect your ability to qualify for life insurance. Minor problems can lead to higher premiums, and major complications can lead to a denied life insurance application.

Because an insurance underwriter considers your overall health in relation to your diabetes, youll typically need to take a medical exam to determine whether youre suffering from diabetes-related complications. Your doctor may need to provide documentation on your behalf that prove any serious complications are under control.

What medical questions might I need to answer?

Depending on your diagnosis, treatment and overall health, you may be required to answer invasive medical questions that include:

How Can I Get The Best Life Insurance

After checking the diabetic type, you can start to look for the best premium. The use of free quotes is the best way to compare the premium of different companies. You can have a look at the right of this post to find the quotes just by entering the zip code.

Here, you will get all the providers offering you the best deals. The more companies you can compare the more attractive offer you may get.

It is better to look at those companies who are working with diabetics patients because they know better what the clients look for.

Can You Get Mortgage Life Insurance With Diabetes

Many people still think that its not possible to get a mortgage unless you have life coverage, which is no longer the case. There are certain countries across the world where this still happens but fortunately not in the UK.

There are however certain situations where you might be asked or even required to have some kind of insurance cover. For example, if you are under a debt management scheme or if you have other debtors then there could be a request to have insurance in place.

It is not a legal requirement for a mortgage lender to insist on life cover so if you are asked to do this then you should question it.

Clearly, its strongly advisable to get a policy in place, especially if youve got dependents or if you have a family to protect so please consider all your options. If youre not sure what to do then you should speak to an expert to get some advice.

Read Also: Best Time To Take Long Acting Insulin

Life Insurance For Type 1 Diabetics

People with Type 1 diabetes are considered higher risk than those with Type 2 and may have a more challenging time purchasing life insurance. Life insurers consider Type 1 diabetes to be less manageable, particularly as it often requires insulin to control.

Life insurance companies consider the age of diagnosis when evaluating risk, as a diagnosis later in life means fewer years when it will impact your body and health. However, Type 1 diabetes is often diagnosed in children or teens, meaning you’d be viewed as a higher risk when applying for life insurance.

Life Insurance For Type 1 And Type 2 Diabetics In Canada

Individuals that have a health condition should not be deprived because of it. However, when it comes to life insurance, they find that this is often the case. Or, at the very least there are major restrictions set upon the type of life insurance they can buy. Individuals that suffer from type 1 and type 2 diabetes often get faced with this type of problem.

Also Check: What Are The New Guidelines For Diabetes

Life Insurance For Diabetics Type 2

If you already have a life insurance policy, but have since been diagnosed with type 2 diabetes, then your policy should still apply. However, if you need to renew your policy you will need to declare your new condition, which is likely to result in higher premiums.

Check your policy terms to ensure that in the event you develop any new condition, such as type 2 diabetes, you will still be covered. However, it is more likely that your pre-existing life insurance policy will cover it.

What Is Life Insurance For Diabetics

Life insurance for diabetics is a contract where the diabetic pays the insurance company premiums, and when the diabetic passes away, the insurer pays a death benefit to the diabetics beneficiary. Diabetics often face higher premiums from insurance companies, and many companies wont insure them at all. Life insurance for diabetics involves working with a company that understands the condition well enough to judge whether the disease is being managed well.

If the applicant can demonstrate through medical exams, lab tests, and a thorough medical history and lifestyle report that they have their diabetes in control and within accepted medical guidelines, then there are companies that will insure them affordably, and just slightly higher than they would a non-diabetic person.

Don’t Miss: Diet For Diabetics With Heart Disease

I Have Diabetes Can I Buy Term Insurance

India is fast emerging as the diabetes capital of the world with 77 million diabetic patients second only to China. Worldwide, one in every sixth person with diabetes is an Indian. In the next 25 years, the number of Indians with diabetes is set to almost double to 134 million, if effective strategies to control this epidemic are not put in place.

The disease prevalence is seen in both men and women equally and increases with age. While 12% of those above the age of 50 years are diabetic, those between 70 to 79 years of age show the highest prevalence at 13.2%. But diabetes is not a condition that solely affects the older segments. 10% of Indian youth have been categorized as pre-diabetic, which puts them at risk of developing the condition in the future.

Genetics, obesity, poor diet and urban lifestyle are some of the risk factors that predict a rise in Type 2 diabetes in the coming years in India. The number of deaths as a result of diabetes is also on the rise. Between 2005 and 2015, deaths due to diabetes increased by 50% according to recent reports.

The rise and rise of diabetes is a worrying factor for many Indians. The families of those succumbing to diabetes could sustain severe financial damage in the long run. And in order to mitigate the financial risk of diabetes, term insurance is proving to be an essential investment for Indian families. Term insurance becomes even more important for a person suffering from diabetes as compared to a healthy individual.

Choosing The Best Life Insurance Policy With Diabetes

When choosing the best life insurance policy for yourself, diabetics need to determine:

- The type of policy

- Level of underwriting

- The amount of coverage needed

We recommend first reviewing your finances and goals to determine how much coverage you may need and how long it will need to remain in force.

These factors will directly influence which policies to consider and the amount of underwriting required to qualify. If you later realize that you want more coverage than you originally purchased, you’ll likely need to undergo additional underwriting. Given you may experience side effects or complications related to your diabetes over time, you risk either not qualifying for additional coverage later on or paying significantly higher rates.

Also Check: Low Carb Meal Plan For Diabetics Type 2

Will Insurance Companies Insure Individuals With Diabetes

In general, Canadian insurance companies have become more liberal. With their life insurance products. At one time any individual that had a pre-existing condition would have difficulty getting life insurance. This was particularly true for those that had type 1 and type 2 diabetes. Now, these insurance companies are finding their risks are less worrisome. Concerning individuals with diabetes may not be as high as they once were. One of the reasons for this is that diabetes type I and type II is controllable. This means that many of them can live a relatively normal life with a normal lifespan. These are two concerns that life insurance providers always have. No matter what the medical condition is.

Life Insurance For Type 2 Diabetics

Type 2 diabetes is considered lower risk by life insurance companies, particularly if you’re able to manage it with lifestyle adjustments or oral medication and have had no complications. Since it is often diagnosed in adulthood, you’re more likely to be viewed favorably by insurers. So long as you’re otherwise healthy and haven’t had complications, having Type 2 diabetes shouldn’t prevent you from getting a policy, although it will affect your life insurance rating and increase how much you pay.

Read Also: What Is Type Ii Diabetes

$100000 Term Life Insurance Standard Rated

| $57 to $73 monthly |

Gestational Diabetes

According to the Mayo Clinic, Gestational diabetes develops during pregnancy . Like other types of diabetes, gestational diabetes affects how your cells use sugar . Gestational diabetes causes high blood sugar that can affect your pregnancy and your babys health. Life insurance for Gestational Diabetics is easily obtained, and oftentimes there are NO extra pemiums accessed to a persons profile.

Any pregnancy complication is concerning, but theres good news. Expectant women can help control gestational diabetes by eating healthy foods, exercising and, if necessary, taking medication. Controlling your blood sugar can prevent a difficult birth and keep you and your baby healthy.

In gestational diabetes, blood sugar usually returns to normal soon after delivery. But if youve had gestational diabetes, youre at risk for type 2 diabetes. Youll continue working with your health care team to monitor and manage your blood sugar.

If you have a history of gestational diabetes, dont think that you cant qualify for life insurance. Life insurance with gestational diabetes is easy to obtain, and oftentimes will have little impact on your rates. Some applicants will have an easy time qualifying for Standard to Preferred life insurance rates. These are the very rates people without Diabetes tend to qualify for.

+ Term Life Insurance For Type 2 Diabetics

According to Investopedia term life insurance is defined as a type of life insurance policy that provides coverage for a certain period of time, or a specified term of years. If the insured dies during the time period specified in the policy and the policy is active, or in force, then a death benefit will be paid. Majority of term life insurance policies provide level premiums, and a guaranteed death benefit, for the duration of the policy.

Term life insurance for people with Diabetes is ideal for people who only need life insurance, for a predetermined amount of time. Oftentimes, due to the lower prices term insurance provides, it may be the most affordable product for you. Over time, as your life and finances change, you can take out additional policies, if needed. Most importantly if you feel you dont need the policy, you could simply cancel the coverage, at any point in time.

Read Also: Whats A Good A1c For A Type 2 Diabetes

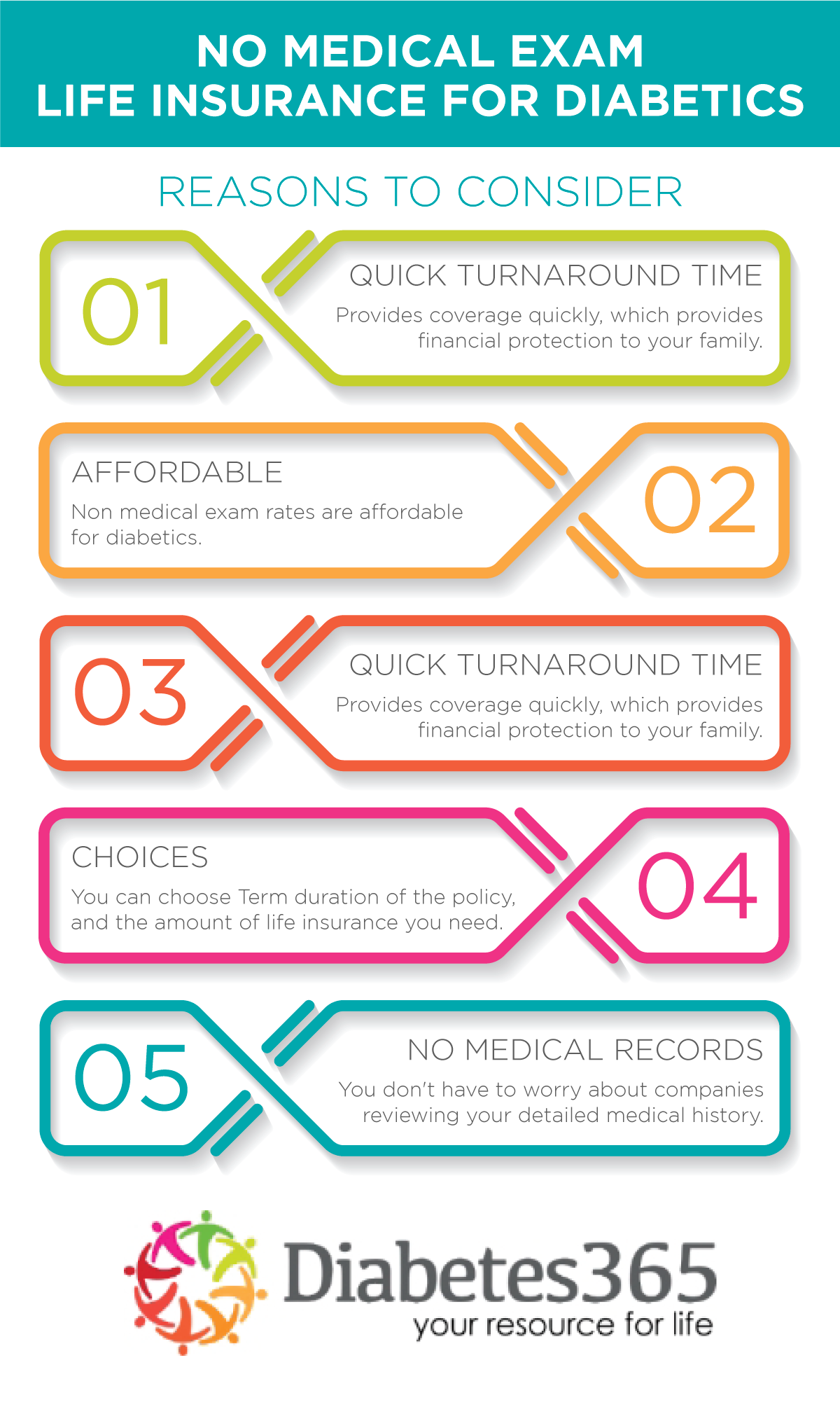

Pros & Cons Of Life Insurance With No Medical Exam

While most life insurance policies take your health into account, there are some policies that do not. These are known as guaranteed issued policies, which may be an option if you have diabetes and are struggling to find insurance elsewhere. Typically, there is a standard waiting period when purchasing the policy. During that waiting period, if the policyholder dies, premiums will be returned but the death benefit will not pay out.

There are several advantages of guaranteed issue life insurance:

-

Medical history does not impact acceptance or premium rates

-

Premium is determined by age

Disadvantages of life insurance policies that donât require medical exams include:

-

Premiums are higher than standard life insurance policies

-

Benefits are lower than standard life insurance policies, with lower maximum death benefits

-

If you die before the waiting period ends, the premiums are returned but no death benefit is paid

How Type 2 Diabetes Impacts Life Insurance Rates & Premiums

Type 2 diabetes is much more common than Type 1 diabetes, is usually milder and is typically diagnosed at a later age.

These factors mean that premiums for someone with well-controlled Type 2 diabetes will usually be lower than premiums would be for a Type 1 diabetes patient. However, a person with Type 2 diabetes will still typically pay higher premiums than someone at the same age who doesnât have diabetes.

Also Check: Is 6.2 A1c Diabetes

Can An Individual With Diabetes Be Refused Life Insurance

Insurance companies have the right to determine who they want to insure. Some individuals feel that if they are turned down, they are being segregated. The insurance company will determine its risks. If they feel the risks are too high for them, then they can exercise their right not to provide life insurance. There may be another insurance company willing to provide them with life insurance.

Getting Term Life Insurance For Diabetes Type :

Term life insurance with diabetes type 2 that is currently being treated is not only possible, but more affordable than getting whole life insurance. If you can reduce your weight to normal levels, then the premiums will be affected in a positive manner so that when the time for renewal comes up you may be paying less.

Life insurance for people with diabetes type 2 is gettable if you take the right steps to address the issues facing your body. Term life insurance is the right type of policy for your needs while guaranteed acceptance should only be taken if the conditions are proper as well.

Compare life insurance quotes and save!

Also Check: Body Wash For Diabetic Skin

What Is A Chronic Illness Accelerated Death Benefits Rider

According to the Centers for Disease Control and Prevention, chronic diseases such as heart disease, stroke, and cancer are among the costliest of all health problems in the United States.

If you were to become chronically ill during the term of the policy, the company would advance up to 90% of the policys coverage amount to help you pay for treatment or to replace lost income.

To qualify for this benefit, a licensed health care practitioner has to verify that youre unable to perform two out of the six activities of daily living .

Faq For Life Insurance With Diabetes

If I have Diabetes, can I even get life insurance?

Absolutely. Life insurance rates are at an all time low, for diabetics. More companies are considering people with diabetes for coverage, than at any other point in time. Depending on your level of diabetes control, and other health history, you may qualify for the same life insurance premiums people without diabetes receive.

Can I still get life insurance during this Covid 19 environment?

Yes, people with Diabetes may still qualify for life insurance during this Covid 19 world we live in. Life insurance companies have made several changes to their underwriting guidelines, and people with Diabetes have been negatively impacted. With this being said, there are still lots of options for life insurance with Diabetes.

Does Diabetes affect life insurance rates?

The answer to this question will ultimately depend on several factors. Diabetes is considered a chronic illness, and life insurance companies may view you as a higher risk in terms of underwriting. In some circumstances diabetes will have NO impact on your life insurance rates. For some people with diabetes, you will pay higher premiums on life insurance.

Given that, having diabetes doesnt necessarily mean you will have to deal with higher premiums. It all depends on your health.

Is it hard to get life insurance with Diabetes?

What types of life insurance policies can diabetics qualify for?

What medical records do I need to provide an insurer with?

You May Like: Can You Go Blind From Diabetic Retinopathy

What Is Diabetes Mellitus

Diabetes Mellitus is characterized by abnormal sugar metabolism, causing hyperglycemia .

Chronic hyperglycemia adversely affects the body.

There can be events such as strokes and heart attacks caused by atherosclerosis in the vascular system. There can also be renal disease, peripheral neuropathy, and blindness.

In the United States, D.M. is a leading cause of end-stage kidney disease, leg amputations, and blindness.

Blood sugar enters cells via insulin, which is a hormone produced by the beta cells of the pancreas. Factors that contribute to hyperglycemia include:

- Reduced insulin secretion,

How Can Diabetics Get A Lower Insurance Premium

As hinted at above, those with diabetes can get a better insurance rating if they keep their blood sugar levels under tight control. Typically, that would mean a hemoglobin A1C result between 6-7. Once your blood sugar levels surpass those numbers, you may be looking at a higher rating, which will increase the cost of your premium.

Other factors like high blood pressure, diabetic retinopathy, diabetic neuropathy, kidney disease, and proteinuria can also affect your rating. While one of these issues may affect any diabetic as they age, if you have tight control and show no symptoms of them at the moment, it may be an opportune time to apply for life insurance as a diabetic.

- Details about your family doctor or endocrinologist

- When you were first diagnosed with diabetes

- What medications or treatment your diabetes requires

- How often you check your blood sugar levels and the results of your most recent hemoglobin a1c blood test

- Any other health conditions you have that are or may be diabetes-related complications

- Your family doctor may be asked to provide an Attending Physicians Report with details about the state of your health

Recommended Reading: Blood Testing Meters For Diabetes

New Cases Of Diabetes In Adults And Children

- In 2018, an estimated 1.5 million new cases of diabetes were diagnosed among U.S. adults aged 18 years or older.

- This includes approximately 210,000 children and adolescents younger than age 20 years.

- During 2014-2015, the estimated annual number of newly diagnosed cases of type 1 diabetes in the U.S. included 18,291 children and adolescents younger than age 20*.

- The annual number of children and adolescents age 10 19 years diagnosed with type 2 diabetes was 5,758.