Price Caps On Insulin Annual Spending Included In Build Back Better Deal Schumer Says

Democrats have reached a deal to lower prescription drug prices as part of their social spending bill, Senate Majority Leader Chuck Schumer announced Tuesday afternoon.

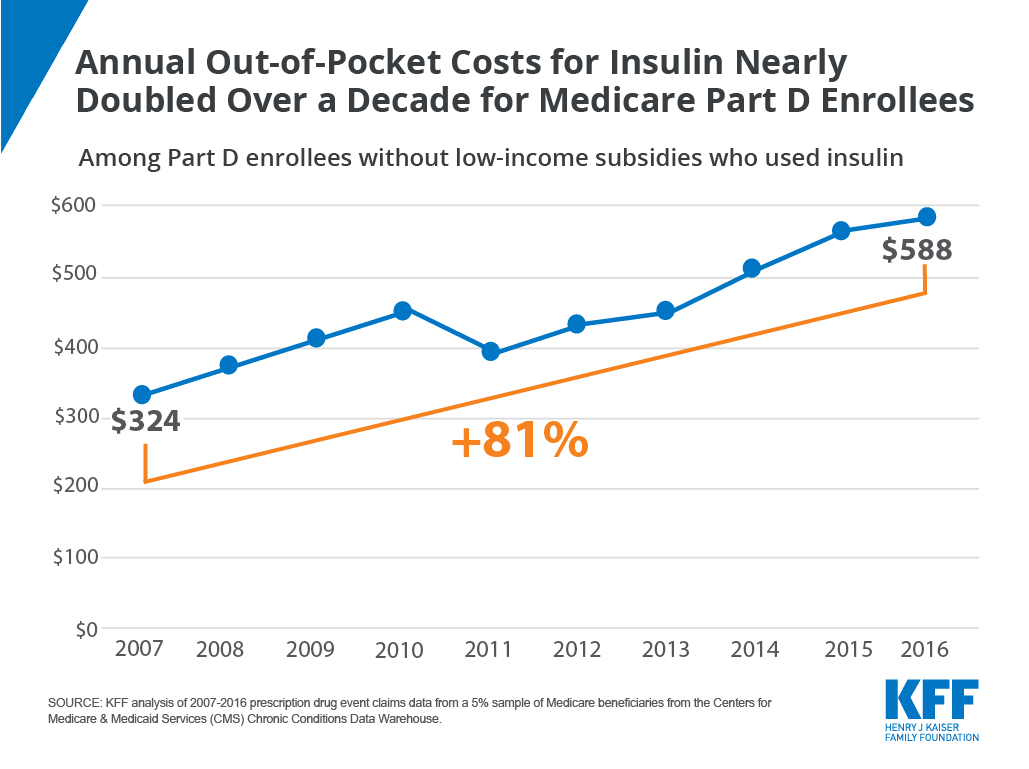

The Build Back Better legislation will cap out-of-pocket spending at $2,000 per year for seniors, allow Medicare to negotiate prices in parts B and D, and lower the price of insulin from $600 to $35, the New York Democrat told reporters.

Schumer said the bill will reduce out-of-pocket drug expenses for “millions of patients.”

“Fixing prescription drug prices has consistently been a top issue for Americans year after year, including the vast majority of Democrats and Republicans who want to see a change because they simply cannot afford their medications,” he said. “We’ve heard this from people across the country who have serious illnesses and can’t afford their medicine.”

U.S. Congressman Scott Peters, a moderate California Democrat who led negotiations, wrote in a statement that the compromise will also penalize manufacturers who raise the price of a drug beyond the inflation rate for drugs in Medicare parts B and D, and that it will establish reporting requirements for pharmacy benefits management.

“It’s not everything we all wanted. Many of us would have wanted to go much further, but it’s a big step in helping the American people deal with the price of drugs,” he said.

Trends In Insulin Prices

Among the 22 insulin therapies that have been on the market since at least 2013, 16 products had average annual price increases of more than 10% between 2013 and 2018, as measured by the change total Part D spending per dosage unit between these years, which far exceeded the 1.5% average annual growth in inflation over the same time period .

Figure 6: Average Annual Price Increases for Insulin Products Far Outpaced Inflation Between 2013 and 2018

It is important to note that this spending measure, and total spending as reported in Part D claims, do not account for rebates, which are not publicly available at the individual product level. The Government Accountability Office has estimated rebates of 41% in 2016 for drugs in the therapeutic class that includes insulin. This is higher than the estimated 20% rebate for Part D covered drugs overall in 2016. While gross total Part D spending on insulin increased from $1.4 billion in 2007 to $13.1 billion in 2017, net total spending would be significantly lower after accounting for rebates.

The level of rebates offered by manufacturers for specific drugs influences coverage and tier placement decisions by Part D plans, which in turn affects out-of-pocket costs paid by enrollees. It has been suggested that the magnitude of list price increases for insulin products over time can be attributed to manufacturers offering increasingly larger rebates for these drugs in exchange for preferred formulary coverage.

What Are The Solutions

According to the American Diabetes Association , there are more than seven million diabetics in this country, and around 27% say that affording insulin has impacted their daily life.

Dr William Cefalu, the ADA’s chief scientific, medical and mission officer, says a lack of transparency is at the root of the issue.

“The system is dysfunctional. There are issues at each level, at each stakeholder in the insulin supply chain,” he says. “We can’t point the finger at one particular entity.”

Fixing issues with high deductibles and ensuring any discounts negotiated with insurance companies actually filter down to patients is key, he says.

Competition would be the best way to bring prices down, so why hasn’t that happened yet?

Unlike chemical drugs, which can be simply replicated, insulin is a biological material – made up of proteins synthesised through a cell line that’s unique to each formula.

But despite these fundamental differences, insulin has long been classified and regulated like a chemical drug.

In December, the FDA announced that the agency would reclassify insulin as a “biological product” by 2020, in what the FDA commissioner called a “watershed moment for insulin”.

These so-called biologics will then have an easier pathway to approval than before, promoting the development of “products that are biosimilar to, or interchangeable with” existing insulin.

For Ms Marston, it’s hard to see why insulin was ever treated like other medications.

You May Like: How Many People In The Us Have Type 1 Diabetes

How Much Does It Cost To Produce Insulin

A 2018 study estimated that one vial of human insulin costs $2.28-$3.42 to produce, and one vial of analog insulin costs $3.69-$6.16 to produce. The study revealed that a years supply of human insulin could cost $48-$71 per patient, and analog insulin could cost $78-$133 per patient per year.

The study measured the manufacturing cost only. It did not include administrative fees, sales, and research and development for improving medications. However, insulin manufacturers have not provided an adequate explanation for this large discrepancy between production costs and retail costs.

Newssome Workers Sickened By Covid

Lawmakers proposing copay caps also have to contend with the health insurance lobby, which has testified against such bills and worked to weaken one that had already passed in Colorado. In May 2019, Colorado became the first state to cap insulin copays for diabetics with private insurance. The situation had become so dire that we needed to pass something right away that would have an immediate impact on the price of insulin, state Rep. Dylan Roberts, a Democrat and the bills author, said in an interview. The law was supposed to set a $100 copay limit on a diabetics entire monthly insulin prescription.

But after the bill was signed into law, the insurance industry convinced Colorado regulators that the cap should apply to each brand of insulin, even though some diabetics rely on multiple brands in a month. The Colorado Legislature hoped to close the loophole before COVID-19 cut the legislative session short. “I wish they would have let us know that they were going to lobby the Division of Insurance for a loophole, Roberts said.

Nine other states Illinois, Maine, New Hampshire, New Mexico, New York, Utah, Virginia, Washington and West Virginia got similar copay limits signed into law. In Utah, the copay cap that passed in April will also benefit the uninsured through a state-funded program that provides a 60 percent discount.

Read Also: Number Of Grams Of Sugar Per Day For Diabetic

White House Mandates Pfizer Vaccines For Millions Of Citizens Before The Fda Clinical Or Safety Reviews Have Been Made Public

There have been several initiatives carried out in the commercial sector to address insulin affordability. Last year, for example, the insurer Cigna and its pharmacy benefit management division Express Scripts announced a program designed to cap out-of-pocket costs for diabetic patients at $25 a month.

Moreover, the recent advent of biosimilar insulin products may help reduce out-of-pocket costs, as could the possibility of automatic interchangeability of biosimilar insulin and originator products.

Nevertheless, for a comprehensive approach to improving insulin affordability that reaches a larger number of diabetic patients the federal government would need to get involved, and it has to a certain extent.

Trump Administration has lowered out-of-pocket insulin costs for some

President Trump has made some dubious claims on insulin prices, including one he uttered during a September presidential debate. There, he boasted that he had helped lower the price of insulin to the point that its so cheap, its like water.

Trump also signed an executive order in July that would require federally qualified health centers to share the steep savings they receive through the 340B program with indigent patients, specifically for epinephrine and insulin products. But, this only applies to a very small portion hospitals participating in the 340B program. And, it doesnt resolve the much larger issue that the 340B program discounts arent generally winding up where theyre supposed to.

How Much Is Insulin In America For Uninsured Patients

The cost of insulin can be devastating for an uninsured person who requires it to manage their diabetes. With the average price ranging from $175 to $300 per vial of insulin, it can become impossible to afford the medications you need. There are programs to help underinsured or uninsured patients afford their diabetic medications and supplies. Ask your doctor for references to national and local programs that can help lower your medication costs. Uninsured Americans with diabetes are more likely to be using older, less effective insulin formulations than those with private insurance or Medicaid. Although these older forms of insulin are more cost-effective, 68% of uninsured patients pay full insulin costs.

Read Also: What Is Considered Low Blood Sugar For Type 2 Diabetes

Costs Of Insulin Pens

Pens usually come in packs, so you cant buy just one at a time.

Depending on your insurance and the pharmacy you go to, a box of five Humalog KwikPens can cost over $600, and the recently released authorized generic can run over $300. Each pen contains 3 mL of insulin.

The cost for Admelog can vary by pharmacy location but runs about $150 per box of five 3-mL insulin prefilled pens.

Your insurance may cover the cost of a pen, but youll likely have to pay a copay out of pocket.

Pens typically cost more up front than syringes and vials. But when it comes to total healthcare costs, choosing pens over syringes may save you money in the long run.

Compared to syringes and vials, one study found that pens were associated with significantly lower total direct healthcare charges. They were also associated with lower total direct diabetes-related healthcare charges.

In other words, since pens make it easier for you to take your insulin, you can possibly avoid costly hospital trips and other complications. This may save you money over time.

Costs Of Insulin Pumps

Without insurance, a new insulin pump costs about $6,000 out of pocket, plus another $3,000 to $6,000 annually for ongoing supplies, like batteries and sensors. The cost varies depending on the features, software, brand, and size of the pump.

But youll also need to pay separately for the insulin delivered via the device, so the cost for using an insulin pump without good insurance coverage can be tremendous.

Recommended Reading: Nursing Care Plan For Diabetes

Costs Of Vials And Syringes

Syringes usually cost between $15 and $20 for a box of 100 depending on where you get them from. Based on where you live, you can purchase them over the counter or online at diabetes supplies stores.

Vial prices vary for each brand and may change with little notice.

For example, a recent internet price search found that Humalogs list price is roughly $325 per 10 ml vial. Admelog is priced at around $200 per 10 ml vial, while the recently released authorized generic of Humalog is priced at $170 per 10 ml vial. The price varied depending upon pharmacy location.

With insurance, a copay and coinsurance rate can be as low as $5, but it can sometimes rise as high as 50 percent or more of the total cost.

Retail pharmacies like Walmart offer older versions of Regular and NPH human insulin for just $25 per vial.

You and your doctor will work together to determine the best insulin for you.

States Tackle High Out Of Pocket Costs For Insulin But Lack Tools To Bring Rx Prices Down

This spring, Congress enacted the most significant expansion of the Affordable Care Act in over a decade, dramatically enhancing marketplace subsidies for health insurance consumers. Left out of that bill, however, were policies to relieve consumers from high prescription drug costs. While Congress continues to debate the issue, states are partially filling the policy void by focusing cost-sharing relief on people who suffer from diabetes.

One in four patients with diabetes reported that they had to ration their supply of insulin because of the high out of pocket cost. The average out-of-pocket cost for insulin over a one year period for a privately insured person is $613, but the cost sharing obligations vary widely across health plan type. There is a growing body of evidence that insulin rationing can worsen health outcomes, and lead to higher costs associated with hospitalizations and other complications. This is prompting many states to enact or consider insulin copay caps. These bills generally impose a statutory limit on how much an insured patient can be charged in cost-sharing for insulin, although they notably do not relieve uninsured patients of their out-of-pocket obligations. Eighteen states have enacted some form of an insulin copay cap and seven others have legislation pending.

Don’t Miss: How Many Carbs Should A Pre Diabetic Eat Per Day

How To Save On Insulin Prices

Contact your insurance company and find out how your policy pays for insulin. Do they pay more for certain types of insulin? Do they exclude certain types? If their payments or exclusions dont work with what you are taking, talk to your healthcare provider about options. Some insurance companies will accept what is called a prior authorization, which means your doctor writes a letter explaining why you need a specific type of insulin. Find out what your deductible is and how you will need to pay out of pocket. Ask if they have any special programs for insulin, such as the one offered by Cigna.

If paying cash, take advantage of programs offered by pharmaceutical companies, such as the one provided by Sanofi. Add in additional costs of supplies to see what you will need to pay each month.

Look into patient assistance programs offered by most major pharmaceutical companies, like Eli Lilly and Novo Nordisk, and some non-profit assistance programs, such as Rx Hope, that provide prescriptions for free or low cost to low-income and uninsured.

Take advantage of a prescription savings card from Singlecare. Over 35,000 pharmacies accept SingleCare coupons. You can enter your zip code online or on our mobile app to find the pharmacy with the lowest price for your insulin. Then, bring in your prescription and your SingleCare card to receive the discount. Joining SingleCare is free.

How We Conducted This Study

We analyzed Medical Expenditure Panel Survey and National Health Interview Survey data from 2014â2017 and 2007â2017, respectively. We then broke these years into three periods: 2014â2017, 2010â2013, and 2007â2009. From the MEPS, we merged the full-year consolidated files, which contained demographic and insurance information, with the prescribed medicines files, which contained information about drug-specific spending. We then took these files and kept all observations of insulin prescriptions to calculate the distribution of insulin out-of-pocket and total costs, both per prescription and overall, for holders of various insurance types in each period. We inflation-adjusted all cost dollar amounts to 2017 dollars, the final year included in our study, and excluded prescriptions to individuals younger than age 18 and older than age 64, or to Medicare patients.

Insulin is sold in varying package sizes and dosages. To facilitate comparisons, we standardized our costs to the cost of a standard 1,500-unit equivalent prescription, using the MEPS variables for drug quantity and strength, and MEPS variables for quantity and strength units. We excluded prescriptions when drug quantity and strength were recorded as unknown.

Variations Among Those With Private Health Insurance

There are substantial variations in the structure of private health insurance, which may have significant implications for out-of-pocket spending. Under many plans, drugs purchased before reaching a deductible must be paid at list price. Beyond this level, payments depend on plan design. According to the Kaiser Family Foundation Employer survey, 91 percent of covered workers in 2017 were in a plan with tiered cost-sharing for drugs. Depending on the tiering structure and drug tier, 21 percent to 81 percent of 2017 plans required a copayment for prescriptions , while 10 percent to 79 percent required coinsurance .16 High-deductible plans typically incorporate coinsurance above the deductible. As plans have moved to higher deductibles, there has been a trend toward coinsurance designs, which more closely tie out-of-pocket payments to list prices.

While the Medical Expenditure Panel Survey does not provide direct information on insurance design, we were able to use the patterns of out-of-pocket payments in this survey data to classify those with private insurance into copayment-only, coinsurance-only, and unclassified groups. Consistent with other studies,17 the fraction of privately insured people who used insulin covered by copayment-only plans dropped from 29 percent in 2014 to 24 percent in 2017, while the fraction in coinsurance-only plans rose from 11 percent in 2014 to about 16 percent in 2017.

How Much Does Insulin Cost Without Insurance In 2021

The cost of insulin has steadily increased over the past few years. This price rise is disproportionate to annual inflation. It poses a threat to people living with diabetes who cannot afford to pay for these increased prices but need insulin to survive. The retail price for insulin can be over $140 for a brand-name Humalog KwikPen however, patients can now pay about $60 for generic insulin such as lispro KwikPen.

MiraRx can help you access insulin for an affordable price. At $25 per month, you can access affordable urgent care visits, low-cost lab testing, virtual care, and more. .

Consumers Can Pay Hundreds More Under Rebate System

Nonprofit drug price research group 46brooklyn released a report demonstrating how patients end up paying more because of rebates.

It looked at a box of Lantus insulin pens which hold pre-dosed cartridges for easier injection with a list price of $425. According to the Finance Committee’s report, Lantus offered the PBM OptumRx a rebate of 79.76% or $339 in 2019.

The consumer’s health plan gets that rebate every month regardless of whether the consumer pays full-price in the deductible phase or pays a smaller co-insurance amount later in the year.

46brooklyn used a fictional consumer who has a deductible of $1,644 a figure the Kaiser Family Foundation says is the U.S. average.

Each month, January through April, the consumer in this scenario would pay close to the full list price for insulin, $408 in this case based on retail price data. Those same months, the health plan, paying $0 toward the insulin, would receive a $339 rebate. The manufacturer of the insulin would get the difference, or $69 in this scenario.

Walmart insulin: Walmart launches its own low-cost insulin to ‘revolutionize’ affordability for diabetics

The rest of the year, once the consumer hit his deductible, he would pay about $34 for insulin each month. The health plan, after rebates, would pay about $35, giving the manufacturer the same total of $69.

The PCMA disputed the accuracy of 46brooklyn’s rebate scenario.